Repayment structure: Rather than fixed regular monthly payments, repayment is structured being a proportion of the organization’s everyday charge card gross sales. This is often known as the “holdback” or “retrieval fee.”

One of the most acknowledged strategy to receive a cash advance is using your credit card to withdraw revenue at an ATM Along with the PIN assigned for your account. Note there may be a financial institution price for using the device, also. Listed below are other ways to get a cash advance:

The amount Will Borrowing Cost Me? Paydayloanspot.com will not insert service costs. We link borrowers by using a lender, and we won't ever demand charges. On the other hand, your lender might incorporate more charges if approved for any financial loan and acknowledge the offer.

Usually, bank card cash advances have higher curiosity prices than common bank card buys. They normally also have fees. So in advance of acquiring a credit card cash advance, be sure to know how much you’ll owe soon after fascination and charges.

It’s developed that can assist you deal with unanticipated expenses or bridge A short lived gap with your cash circulation, which makes it a convenient alternative after you need funds speedily.

Underneath, CNBC Decide on testimonials the fundamentals of the cash advance: what it is actually, the phrases and fees, and superior solutions for receiving cash rapidly.

Component rate: The cost of the MCA is frequently expressed as an element level as opposed to an fascination level. The factor price can be a multiplier applied to the advance volume to determine the full repayment.

APR Disclosures & Repayment Phrases Annual Percentage Price (APR) can be a measure of the price of credit score, expressed like a nominal yearly price. It relates to the quantity and timing of price gained by The customer to get more info the amount and timing of payments produced. EiLoan can not assure any APR considering the fact that we are not a lender ourselves.

Depending on the credit card issuer, you may be able to obtain a cash advance by browsing your financial institution, withdrawing income at an ATM or composing a advantage check. Right here’s a closer take a look at how these choices function:

Within this area, We are going to explore the pros and cons of cash advances, inspecting the advantages of fast access to resources, benefit, and accessibility, as well as the opportunity downsides which include significant expenses, curiosity rates, and the potential risk of getting into a cycle of debt.

Swift approval system: Payday financial loans usually have A fast approval process, with nominal documentation and credit checks. No collateral demanded: Payday loans are unsecured, meaning borrowers are usually not necessary to provide collateral to safe the loan.

Observe that cash advance checks vary from promotional APR checks that banking institutions may perhaps provide once in a while. Employing a promotional APR Examine helps you to access funds at a decrease amount than a cash advance—or sometimes even decreased than your common APR.

Deposits beneath any of these trade names are deposits with Environmentally friendly Dot Financial institution and are aggregated for deposit insurance protection up towards the allowable restrictions.

Due to the fact cash advances come with substantial desire rates and costs, you'll want to only get a single within an Excessive emergency when no other available choices can be found. A cash advance need to be a last vacation resort.

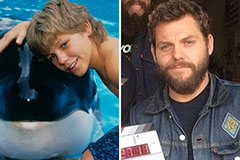

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!